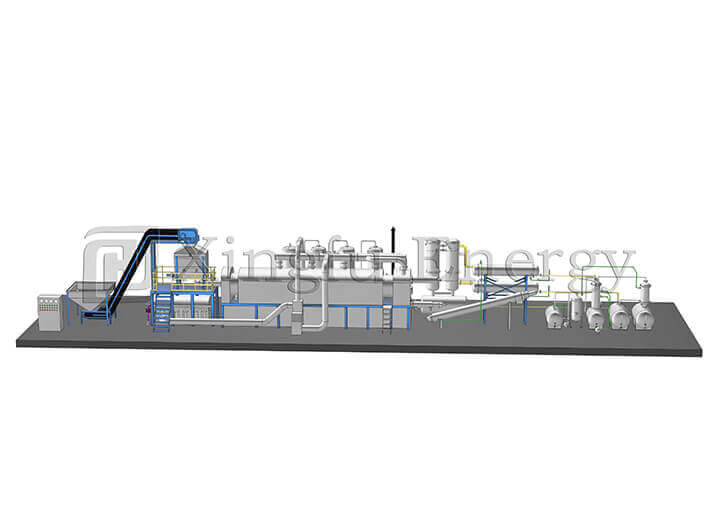

Think about the stacks of old tires piling up at your facility. Each one a headache—taking space, drawing fines, and begging for a better end than the landfill. You’ve probably eyed batch systems before. They work fine for small runs. But when volumes climb into the tens of tons daily, things shift. Enter the 30T fully continuous pyrolysis plant. It keeps the feed flowing non-stop, turning scrap into oil, carbon black, and steel without the usual pauses. No more babysitting batches or scraping residue. Just steady output that matches your grind. For outfits chasing high-volume recycling, this setup raises the bar. It promises yields that stack cash and cuts waste to near zero. But does it deliver as the endgame? Let’s dig in.

Batch pyrolysis has its place. Load up, heat, wait, unload—repeat. It’s straightforward for starters. Yet as your tire intake surges—say, from a city depot dumping 20 tons a day—downtime starts biting. Cleaning reactors, swapping loads, that all adds hours. And hours mean lost revenue.

A fully continuous plant flips the script. Tires feed in steadily via conveyor. The reactor spins on, cracking material around the clock. No stops for coking or clogs. We’ve talked to managers in Southeast Asia who ditched batches after hitting 15 tons daily. Their output jumped 40% overnight. Why? The system handles uneven feeds—mixed sizes, wet scraps—without choking. And labor? Drops to two or three folks per shift, monitoring gauges instead of shoveling.

At heart, it’s about uptime. A 30T model like the XFLJ-30 processes a full 30 tons every 24 hours. That’s oil at 45-50% yield, enough to fill tanks weekly. Carbon black at 32-36% for resale. Steel wire pulling 2-14%, straight to scrap yards. Syngas? 3-5%, burned right there to keep things humming. No external fuel after startup. Just 400 kg to kick off, then self-sustains. Power draw sits at 190 kW total—running steady, not spiking like batches.

Step up close to a running unit. The reactor—built from tough Q345R steel—rotates smoothly at normal pressure. Temps top out at 650°C, but controls keep it even. Tires, pre-chopped to 20mm bits, slide in via feeder. No jams. The anti-coking design scrapes walls clean as it turns. Heat comes from hot air circulation, paired with low-temp catalysts. That combo stretches the reactor’s life to 10 years, easy.

As cracking happens, vapors rise to a gas-liquid separator. Multilevel cooling kicks in—condensers layered for max capture. Oil drops out heavy, light fractions condense into usable cuts. What’s left? Non-condensables head to a waste gas tank. Desulfurization scrubs them, vacuum pulls to a water seal, then boom—back to the furnace as free heat.

Downstream, it’s all automatic. Slag remover spits coarse carbon and wire. A magnetic separator sorts them quick—black to a cooling hoist for grinding into sellable powder, wire compressed for melt-down. Enclosed the whole way, so no dust clouds or leaks. Exhaust? Multistage scrubbers hit European emission standards. Nitrogen blow adds flame retardancy if things get dicey.

Footprint’s no joke: 36m x 8m floor space, up to 7m high in spots. But it fits most industrial yards. Install takes a crew a couple weeks, per sites we’ve seen in Poland. Running power? 190 kWh hourly, but syngas covers the heating tab.

Economics first. Oil sells at $400-600/ton these days. At 45% yield, that’s $6,000-9,000 daily from fuel alone. Carbon black? $200/ton industrial grade. Wire fetches $150/ton scrap. Syngas saves $500/day in gas bills. Subtract 190 kW power at $0.10/kWh—$456 daily—and labor at $200/shift. Net? $5,500+ per day. Payback hits 12-18 months for a $1.2M setup, per Indonesian installs.

But it’s not all green lights. Upfront? Steeper than batch—$1M vs. $600K for 20T intermittent. Space needs bite too; that 288 sqm layout means planning. And feed quality matters. Too much bias ply? Yields dip 5%. We’ve heard from a Korean yard: Started strong, but ignored pre-shredding. Oil went viscous, sales slowed. Fix? Added a chipper upfront. Problem solved.

Environmentally, it’s a win. Cuts tire-to-landfill by 95%. Emissions? Below EU limits—particulates under 10mg/m³, SOx slashed 80% via scrubbers. One Spanish site reported zero fines post-install, up from quarterly hits. Carbon footprint? 70% less than incineration, per lifecycle audits.

| Output | Yield (% of Input) | Daily from 30T | Market Value (est. $/ton) | Daily Revenue (est.) |

| Fuel Oil | 45-50% | 13.5-15T | $400-600 | $5,400-9,000 |

| Carbon Black | 32-36% | 9.6-10.8T | $200 | $1,920-2,160 |

| Steel Wire | 2-14% | 0.6-4.2T | $150 | $90-630 |

| Syngas | 3-5% | 0.9-1.5T equiv. | Internal (savings) | $500 (fuel offset) |

Totals add up quick. And that’s before grants for green tech in places like the EU.

Chat with a Texas recycler last year. They scaled from 10T batch to this 30T continuous. Tires from truck stops flooded in—dirty, varied. Batch couldn’t keep pace; backups hit 500 tons. Switched over? Processed 900 tons monthly, oil output tripled. “No more midnight cleanouts,” the ops lead said. Revenue? Up 250% year one. Hiccup: Initial catalyst tweak for local rubber blends. Took a week, but yields stabilized at 48%.

Over in Indonesia, a palm oil waste mixer tried blending plastics. Yields held, but oil smelled off—needed extra desulfur. Cost $10K fix, but payback sped up with dual feeds. Lesson? Test small. These stories show: For 20T+ volumes, continuous rules. Below that? Batch might suffice.

High-volume means different things. Hauling municipal contracts? This plant eats 10,000 tons yearly. Private fleet scraps? Still overkill unless expanding. Key: Match intake to capacity. Pre-invest in shredders—20mm spec keeps flow smooth. And site it right—vent stacks clear, power grid beefy for 190 kW.

Maintenance? Quarterly checks on seals, yearly catalyst swap. Downtime? Under 5% with good ops. Ties you in long-term—steady fuel means repeat buys from your oil. Builds that sticky client base.

Qingdao Xingfu Energy Equipment Co., Ltd. kicked off in 2010 right in Qingdao, Shandong. They’ve stuck to the grind: crafting industrial boilers, pressure vessels, and pyrolysis rigs for tires and plastics. With 228 folks on payroll—78 techs deep in R&D, including 28 engineers, plus 65 certified welders—they churn out gear that’s CE- and ISO9001-vetted. A-level boiler stamps, pressure vessel licenses, the works.

Their shop spans 70,500 sqm, 21,000 under roof. Domestic sales? Topped 100 million RMB yearly since 2012. Exports hit 30+ countries—Indonesia, Poland, Spain, you name it. It’s not flashy; it’s reliable. They back every plant with install crews and remote tweaks, turning first-time buyers into decade-long partners.

So, is the 30T fully continuous pyrolysis plant the ultimate for high-volume tire recycling? Damn close. It turns chaos into cash flow—steady yields, low fuss, green creds that open doors. Sure, it demands upfront sweat. But for yards pushing scale, the math and stories don’t lie. If your piles are growing, this could be the move that levels you up.

What’s the edge of a fully continuous pyrolysis plant over batch for tire recycling?

A fully continuous setup like the 30T model runs non-stop, feeding and processing without pauses. Batches need load-unload cycles, eating hours. Result? 30 tons daily steady, with 45-50% oil yields and self-heating via syngas—no fuel bills after startup.

How much space and power does a 30T fully continuous pyrolysis plant really need?

It takes a 36m by 8m footprint, up to 7m high. Power’s 190 kW total—about 190 kWh hourly. Fits most industrial lots, and syngas covers heating, keeping runs cheap once rolling.

Can a fully continuous pyrolysis plant handle mixed or dirty tires straight from the yard?

Yep, pre-chop to 20mm and it chews through. Anti-coking reactor and auto-sorters manage grit. Sites in Asia report 90% uptime even with wet batches, pulling consistent 32-36% carbon black.

What safety bits come standard on a 30T fully continuous pyrolysis plant?

Enclosed design kills leaks and dust. Multistage scrubbers meet EU emissions. Nitrogen for fire retard, pressure controls, and rotating scraper prevent clogs. Ten-year build life from Q345R steel.

How quick does a fully continuous pyrolysis plant pay back on a 30T scale?

Often 12-18 months. Oil at $500/ton nets $7,000+ daily from 15 tons yield. Add carbon and wire sales—$2,500 more. Minus power and two-person shifts, you’re banking $5,500 net. Real yards hit it faster with grants.