Hey, if you’re knee-deep in the waste management game or eyeing ways to turn scrap tires into cash, you’ve probably wondered about pyrolysis plants. Those heaps of discarded tires piling up everywhere? They’re not just an eyesore—they’re a goldmine waiting to be tapped. But the big question folks keep asking is simple: How much oil can you really squeeze out of a 20-ton setup? We’re diving deep into that today, zeroing in on batch type plants that handle waste tires efficiently. Stick around, and you’ll get the straight facts, backed by real numbers and practical insights, to help you decide if this tech fits your operation.

Pyrolysis isn’t some fancy lab trick; it’s a proven way to break down old tires without burning them up. Picture this: you heat the tires in a sealed chamber with no oxygen around. The rubber turns into useful stuff like fuel oil, carbon black, and even steel wire you can sell. For anyone running a recycling business or looking to cut landfill costs, this process flips waste into profit.

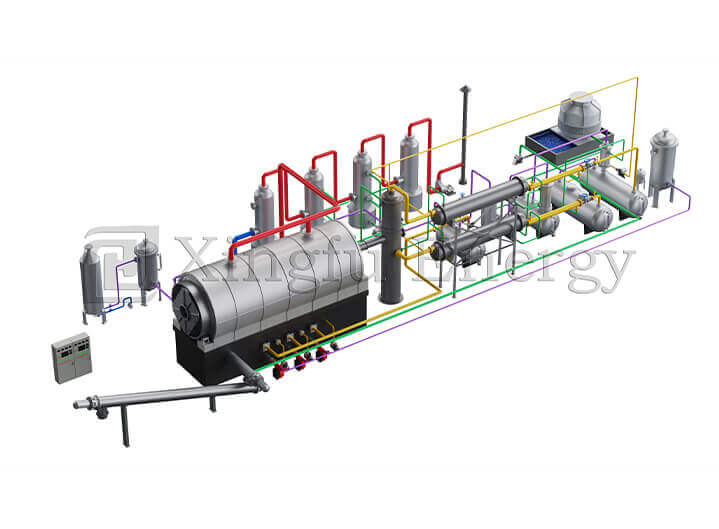

It starts with loading whole tires into the reactor—no need to chop them up first in a solid batch type system. Heat kicks in, usually around 650°C or less, and the magic happens. Vapors rise, cool down into oil, while solids like carbon black and wire get separated out. Leftover gas? It often loops back to fuel the plant itself. Simple, right? But the real payoff shows in the output splits.

A 20-ton plant strikes that sweet spot for mid-sized operations. It’s big enough to process serious volume—think handling truckloads from local garages or tire shops daily—without needing a massive footprint. If you’re starting out or scaling up from smaller rigs, this size lets you test the waters without breaking the bank on setup.

Oil yield is the star of the show here. Customers always hit me with, “How much oil will I actually get?” And honestly, it’s not a one-size-fits-all answer. But for waste tires in a batch type pyrolysis plant, you’re looking at solid returns that make the math work.

A bunch of things play into it. Tire quality matters—radial tires with more rubber give better yields than bias-ply ones loaded with fabric. Temperature control is huge; too hot, and you burn off potential oil into gas. Feedstock prep counts too. In batch type setups, you can toss in whole tires up to 1200mm, skipping the shredding step that semi-continuous plants demand. That saves time and keeps yields steady.

Moisture? Keep it low, or it’ll sap energy. And don’t forget the catalyst—some plants use low-temp ones to boost efficiency without jacking up costs.

From hands-on runs and industry logs, a 20-ton batch type plant typically pulls 40-45% oil from waste tires. That’s no fluff; it’s based on standard radial tires. Break it down: Out of 20 tons fed in, you get 8-9 tons of fuel oil per day. Carbon black clocks in at 32-36%, around 6.4-7.2 tons, perfect for pigments or rubber fillers. Steel wire? 14-16%, or 2.8-3.2 tons, ready for scrap yards. Syn gas wraps it up at 5-8%, often reused onsite to cut fuel bills.

Want to see it in black and white? Here’s a quick table on expected outputs for a single 20-ton batch:

| Product | Yield Percentage | Daily Output (Tons) | Potential Uses |

| Fuel Oil | 40-45% | 8-9 | Diesel substitute, heating fuel |

| Carbon Black | 32-36% | 6.4-7.2 | Tires, inks, plastics |

| Steel Wire | 14-16% | 2.8-3.2 | Recycling into new steel |

| Syn Gas | 5-8% | 1-1.6 | Plant fuel, power generation |

These figures come from real setups, not lab dreams. Say you’re in a bustling city with tire waste from fleets— that 8-9 tons of oil could fetch $400-500 per ton on the market, depending on crude prices. Do the math: $3,200-4,500 daily revenue from oil alone, before selling the rest.

Let’s get specific about what a 20-ton batch type plant looks like. These aren’t clunky old machines; they’re built tough with Q345R steel to handle the heat.

Heating options? Go direct or hot air— the latter evens out temps for better yields. And safety’s baked in with steam blow for flame control and normal pressure ops.

In action, it’s straightforward. Load tires via conveyor, heat up, extract vapors through multi-stage condensers for max oil capture. Dust? Handled with pulse removal—no mess. One operator shared how their plant in a coastal yard hit 42% oil consistently, turning 20 tons of mixed truck tires into 8.4 tons of oil daily. That’s real profitability, folks.

Not all pyrolysis is created equal. Batch type stands out for its simplicity, but how does it stack against semi-continuous or fully continuous?

Batch type shines for starters. You process one load at a time, cool down, then reload. Downtime? Yeah, about 4-6 hours between cycles, but it means lower upfront costs—often 20-30% less than continuous setups. Oil yields hold steady at 40-45%, same as pricier models, because the sealed reactor maximizes heat retention. Plus, handling whole tires cuts prep labor.

Semi-continuous lets you feed material while running, slashing downtime. But tires need shredding to 50mm pieces first, adding a step. Yields? Still 40-45% for tires, but you might squeeze an extra percent from better heat flow. Great if you’re scaling, but expect higher power draw—75 kW/hour running vs. batch’s 60.

These beasts run 24/7, no stops. Ideal for huge volumes, but setup’s complex and costly. Oil yields match batch at 40-45%, but efficiency gains come from zero downtime. Downside? More maintenance, and if something jams, the whole line halts. For a 20-ton need, batch often wins on cost-yield balance.

In short, if your goal’s reliable oil output without fancy bells, batch type delivers. One recycler I know switched from semi to batch and boosted net profits by 15% through simpler ops.

Imagine a tire depot in the Midwest, drowning in 500 tons monthly. A 20-ton batch plant chews through that, spitting out 120-135 tons of oil a month. At $450/ton, that’s over $54,000 revenue, minus $10,000 in ops (fuel, labor). Net? Solid margins. Or take a smaller outfit in Asia: They mix tires with plastics, hitting 43% oil average, and sell carbon black locally for extra bucks.

Data from installs shows batch plants recover investment in 1-2 years, thanks to those 40-45% yields. No hype—just cold, hard results.

Before wrapping up, a quick nod to the folks making this tech reliable. Qingdao Xingfu Energy Equipment Co., Ltd. has been in the game since 2010, cranking out industrial boilers, pressure vessels, and top-notch waste tires & plastics pyrolysis systems. Based in Shandong, China, they’ve got CE and ISO creds, plus exports to 30+ countries. With a team of engineers and welders, they focus on durable, efficient gear that stands up to real-world use. If you’re hunting for a pyrolysis supplier, they’re the ones turning ideas into working plants.

Wrapping this up, a 20-ton waste tyre pyrolysis plant isn’t just about recycling—it’s a smart play for steady profits. With oil yields hitting 40-45%, you’re looking at 8-9 tons daily, enough to fuel your bottom line. Batch type keeps it simple and cost-effective, especially compared to fancier continuous options. If turning waste into wealth sounds good, dive in with solid tech from pros like Qingdao Xingfu Energy. Ready to boost your operation?

In practice, you can expect 40-45% oil yield from standard waste tires in a batch type setup. That translates to 8-9 tons of fuel oil per day, depending on tire quality and process tweaks.

Batch type offers similar 40-45% yields but with easier whole-tire loading and lower costs. Semi-continuous cuts downtime by allowing ongoing feeds, but it requires shredded tires, which might add prep time without boosting oil much.

Absolutely—4-6 people handle it fine, from loading to output processing. It’s designed for straightforward ops, making it ideal for smaller teams.

Tire composition plays a big role; radials give better results. Keep moisture low, control temps under 650°C, and use efficient condensers to hit that 40-45% mark consistently.

You bet. With daily oil output at 8-9 tons, plus sellable carbon black and wire, many operators see ROI in under two years. Factor in market prices, and it turns scrap into serious cash.